Linda’s insurance company didn’t tell her about this — did yours?

Two months ago, 60 years old native Milwaukeean Linda Pearl, needed to save some money on bills after her and her husband recently retired after 35+ years from the Post Office. Her old boss was always great with money so she reached out for advice.

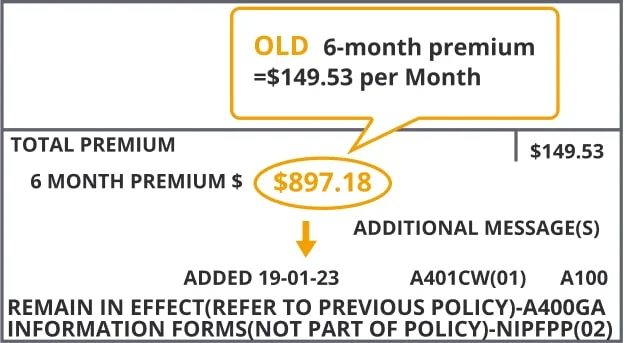

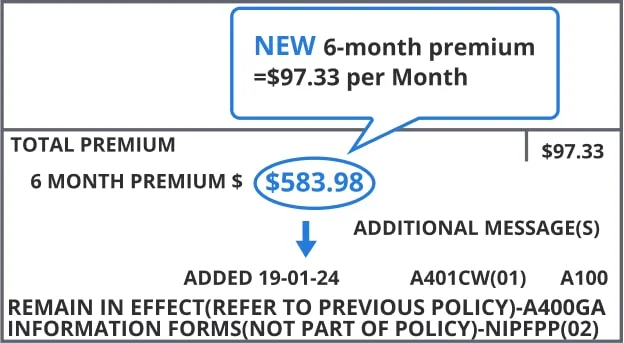

Looking over her bills, he found she was paying triple what he was for insurance -- yet she owned her home much longer than him.

He told her she needed to fix this immediately.

Her husband John usually handled all the insurance bills but he had the flu and was in no shape to call anyone. So Mrs. Pearl was forced to do her own research.

There is a new rule that most homeowners don't know about that is costing insurance companies millions in premiums already.

Linda entered her zip code at this Comparison Website and was amazed when she saw how much more expensive her local insurance agency had been for the last 8 years.

“I lowered our insurance premiums by 75% thanks to the new rule. I dropped my old insurance for not telling me about this. I only wish I found out about this rule sooner.” — Linda

Here are the new rule requirements by the current administration:

If you meet at least 2 of these requirements, you may be eligible for significant savings

When adult homeowners go to InsureMyHome, they get an unbiased view of the best rates in their area which include any and all new rules that have been recently implemented.

Here is the lesson to learn – NEVER buy insurance without comparing rates on sites that are unbiased AND include updated homeowner rules.

As an authority on everything insurance, we decided to put this service to the test and after entering our zip code we were shocked at the results we found: