Linda’s insurance company didn’t tell her about this — did yours?

A couple of months ago, 62-year-old Seattle native Miranda Holloway needed to save some cash after she and her husband recently retired from their teaching jobs after 35+ years. Her old friend, who was always smart with money, suggested she look over her bills.

When he took a look, he saw that Miranda was paying almost double what he was for home insurance, even though she'd owned her house way longer.

He told her, "You need to fix this ASAP."

Miranda’s husband, Tom, usually handled all the insurance stuff, but he was down with the flu and couldn’t make any calls. So Miranda had to dive into the research herself.

Turns out, there’s a new rule that most homeowners don’t know about, and it’s already costing insurance companies millions in lost premiums.

Miranda entered her zip code on This Website and couldn’t believe how much she had been overpaying for the last 8 years.

"I slashed our insurance costs by 75% with this new rule. I ditched my old insurance for not letting me in on it. Wish I knew about this sooner!" — Miranda

Here are the new rule requirements by the current administration:

If you meet at least two of these requirements, you can claim significant savings

When adult homeowners contact Home Coverage Online, they get an unbiased review of the best rates in their area that include all the new rules recently enacted.

Here's the lesson to be learned: NEVER buy insurance without comparing rates on websites that are unbiased and include updated rules for homeowners.

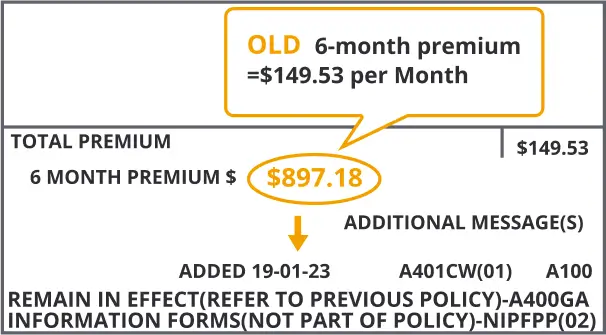

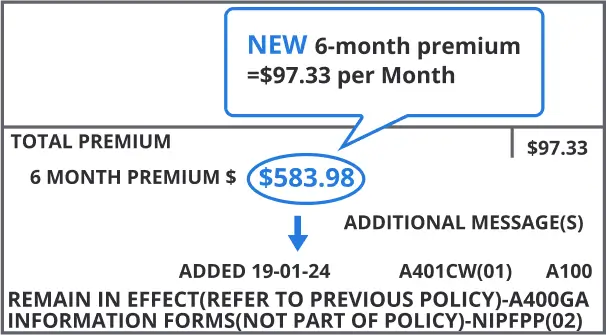

Being an authority on all things insurance, we decided to put this service to the test and upon entering our zip code, we were shocked at the results: